HSBC & Barclays Data Breach: Sensitive Information Leaked

Major data breach at HSBC & Barclays! Sensitive data leaked online by infamous hacker IntelBroker. Learn what happened and how it might impact you. #CyberSecurity #DataBreach

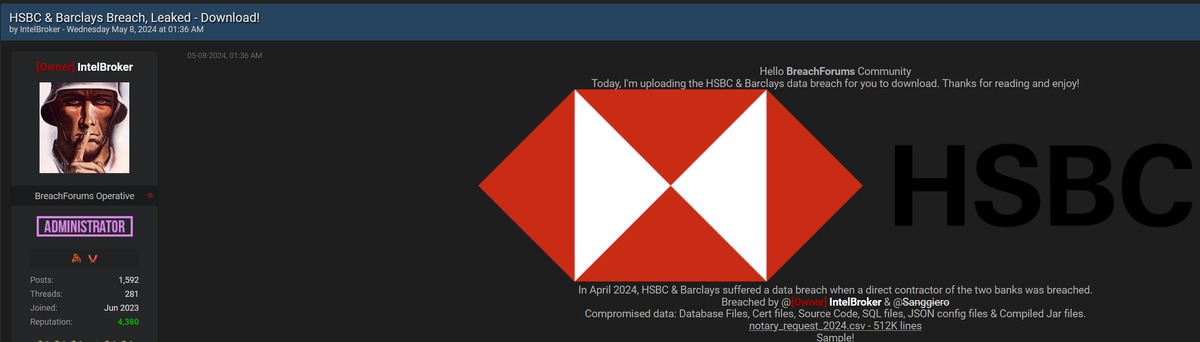

In a significant development in the cybersecurity world, HSBC and Barclays, two of the world's largest and most prominent banking institutions, have fallen victim to a data breach. The breach, reportedly occurring in April 2024, was disclosed by the notorious hacker known as IntelBroker, who is a well-known figure within the underground hacking community. This breach has raised serious concerns about the security protocols in place at these financial giants, particularly given their global importance and the sensitivity of the information they handle.

Company Overview

HSBC (Hongkong and Shanghai Banking Corporation) is a British multinational bank and financial services holding company. It is one of the largest banks in the world, with a global presence in over 64 countries and territories. HSBC offers a wide range of services, including retail banking, wealth management, commercial banking, and global banking and markets. HSBC has been in operation since 1865 and has a long history of serving millions of customers worldwide.

Barclays is another British multinational bank, with a history dating back to 1690. It operates in over 40 countries and provides services across various sectors, including retail, corporate, and investment banking, as well as wealth management. Barclays is also known for its innovation in banking and finance, having introduced the world's first cash machine (ATM) in 1967.

Breach Details

According to the post shared by IntelBroker on BreachForums, the data breach occurred due to the compromise of a contractor working with both HSBC and Barclays. The breach involved the unauthorized access to a variety of sensitive data types, including:

- Database Files: Detailed records of financial transactions, customer data, and potentially sensitive banking information.

- Certificates: Digital certificates used for securing communications and verifying identities within the bank's network.

- Source Code: Potentially the proprietary code that could expose vulnerabilities or methods of operation within the banks’ systems.

- SQL Files: Databases in SQL format that might contain customer details, transaction logs, and other critical information.

- JSON Config Files: Configuration files that could provide insights into the internal architecture and operations of the banks.

- Compiled JAR Files: Java Archive files that could include executables used in the bank's applications.

The post also included a 512KB sample CSV file named notary_request_2024.csv, suggesting that it contains a portion of the leaked data.

Threat Actor Profile: IntelBroker

IntelBroker is a well-known hacker within the cybercriminal community, often associated with high-profile data breaches. Operating under the guise of an administrator on BreachForums, IntelBroker has built a reputation for targeting large corporations, particularly those in finance, healthcare, and technology sectors. Previous activities by IntelBroker include breaches of other financial institutions and large-scale leaks of personal data, causing widespread disruption and financial loss.

Impact Analysis

The consequences of this breach could be severe, given the nature of the compromised data. If sensitive customer information has been exposed, this could lead to various forms of financial fraud, identity theft, and targeted phishing attacks. For HSBC and Barclays, the breach could result in significant financial penalties, loss of customer trust, and potential regulatory scrutiny. Both banks will likely need to undertake comprehensive internal reviews of their security measures and may face class-action lawsuits from affected customers.

Historical Context: Prior Breaches

This is not the first time that either bank has faced cybersecurity challenges. HSBC has previously dealt with data breaches, notably in 2018 when unauthorized access to several accounts exposed personal information such as account numbers, balances, and transaction histories. Similarly, Barclays has encountered its share of cybersecurity incidents, including a 2017 breach where over 27,000 files of confidential customer data were leaked.

These previous incidents highlight the ongoing struggle that even the largest and most secure financial institutions face in protecting their data against increasingly sophisticated cyber threats.