Huione Guarantee darknet marketplace, and it's scammers

Tether and Huione Guarantee are at the heart of a multi-billion dollar criminal economy and regulators are still playing catch-up.

If you’ve heard the term pig butchering and assumed it was niche, think again. This is not just some fringe online scam—it’s a massive, transnational, industrial operation with billions of dollars in play, and the New York Times just pulled the curtain back.

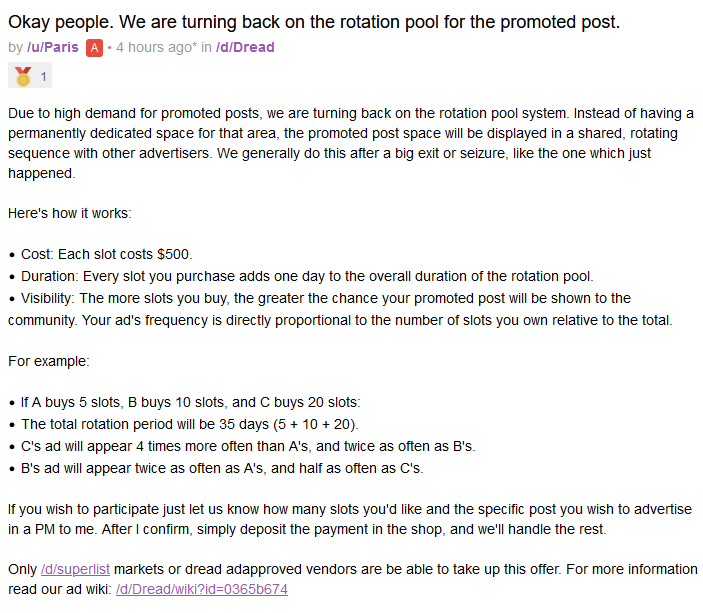

The March 23 investigation details how scam factories in Southeast Asia—specifically those tied to Huione Guarantee, a rebranded version of a notorious Cambodia-based darknet marketplace—operate with terrifying efficiency. We're talking about full-fledged scam toolkits: from slick web development services to literal cattle prods used on trafficked laborers who fail to hit their extortion quotas. And it gets darker.

The laundering side of the business runs just as smooth. Once victims wire money, it enters a global shuffle coordinated by so-called matchmakers—middlemen with deep networks of ‘mules’ using shell companies, bank accounts, and crypto wallets to wash stolen funds. The mules take a cut. The matchmaker takes a bigger cut. And every step of the way, affiliates like Huione International Pay and other departments within this ecosystem take theirs too. The scam money moves fast, and it moves often—especially into crypto.

And of course, Tether is the recurring character in this never-ending financial crime drama.

The Times found that stolen funds from U.S. victims were moved through Bahamian banks—then converted into USDT, Tether’s flagship stablecoin, via Binance. From there, the money lands in Cambodian casinos or winds its way through Huione’s own payment channels. Tether has a long, murky history with Bahamas-based banks like Deltec and Capital Union, relationships born out of Tether’s inability to keep stable ties with U.S. banks.

Last year, Elliptic revealed over $11 billion in USDT had been funneled through Huione-linked wallets in just three years. Tether responded by freezing a mere $30 million—basically a rounding error—only after those same wallets were linked to North Korea’s Lazarus Group. If that hadn’t happened, would they have acted at all?

Meanwhile, Huione’s attempting to reduce dependence on USDT by launching its own knockoff: USDH. They marketed it as a stablecoin free from the regulatory headaches that plague Tether. The kicker? Blockchain security firm CertiK actually audited USDH. CertiK later apologized, claiming they were duped into working with Huione by a third-party agency—but the damage was done. The audit carried their logo, giving the appearance of legitimacy, even if the fine print flagged serious flaws.

Now, in a move so tone-deaf it borders on satire, Tether CEO Paolo Ardoino and Tron’s Justin Sun are heading to the DC Blockchain Summit to speak on cybercrime prevention. That’s right—two of the most controversial figures in crypto, whose products have been repeatedly linked to financial scams, are now positioning themselves as crime-fighters.

Tether is simultaneously pushing a PR campaign about its supposed new commitment to transparency. Ardoino claims Tether is “engaging” with a Big Four accounting firm to finally audit its $143.5 billion in USDT reserves. But let’s be real: “engaging with” is a non-phrase. It’s vapor. If this audit were above board, it would’ve happened years ago.

Hiring an auditor isn’t some mythical ordeal. For companies with clean books, it’s routine. The fact that Tether still hasn’t crossed this line screams that they’ve got something to hide. And if that’s the case, the real question is: why are regulators still letting them operate?

The systemic rot here is wide, and it’s global. From Bahamian banks to Southeast Asian compounds, from pseudo-compliance lip service to crypto platforms laundering billions, the infrastructure of online scamming is mature, well-oiled, and brazen. Tether and Huione aren’t just cogs in the machine—they are the machine.