Lenme Data Breach: Personal Information of 846K Users Leaked Online

Lenme has experienced a significant data breach, affecting 846,000 users. Personal and financial information was compromised. #CyberSecurity #DataProtection

📌 Company Overview

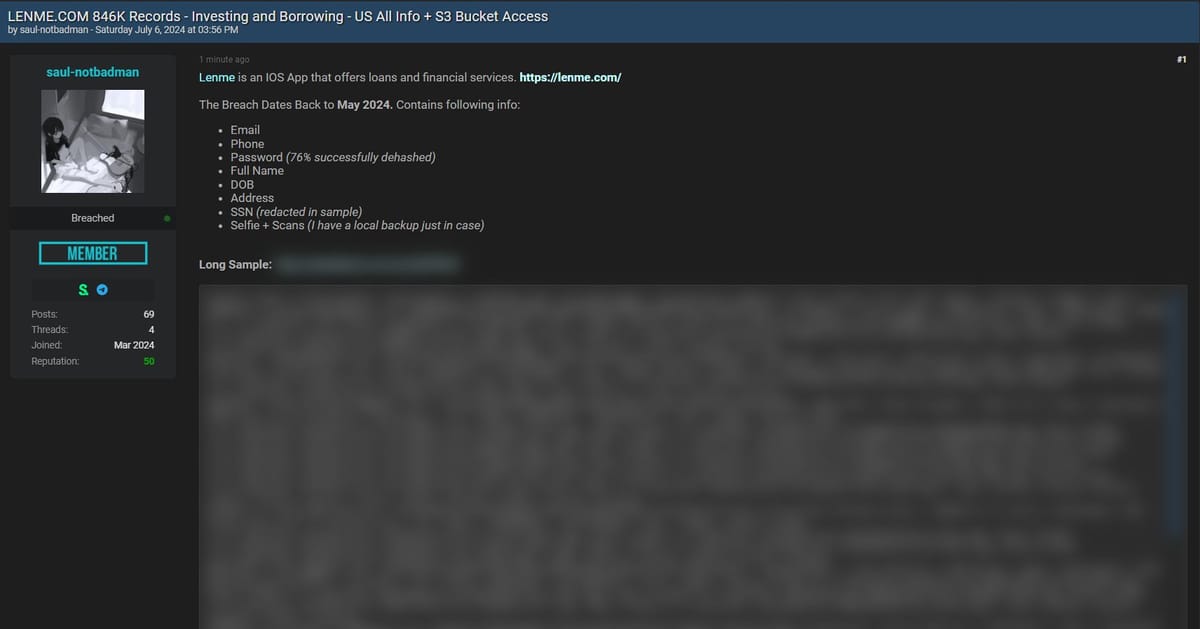

Lenme is a mobile app offering loans and financial services, aimed at simplifying the borrowing and investing process. The app connects lenders with borrowers, providing a platform for financial transactions.

- Website: Lenme

- Services: Personal loans, investment opportunities

- Platform: iOS

🔍 Breach Details

Date of Breach: May 2024

Records Compromised: 846,000

Discovered By: Forum user "saul-notbadman" on July 6, 2024

Exposed Information:

- Email addresses

- Phone numbers

- Passwords (76% dehashed)

- Full names

- Dates of birth (DOB)

- Addresses

- Social Security Numbers (SSN) – redacted in the sample

- Selfies and scans (identity verification images)

🕵️♂️ Threat Actor Profile

The breach was disclosed by a forum user "saul-notbadman," who appears to have access to the compromised data. The individual claims to have a local backup of the data and has provided a long sample for verification purposes. The forum post indicates that the data includes sensitive personal information and credentials.

📊 Impact Analysis

The data breach has significant implications for affected users:

- Identity Theft: Exposure of personal information such as SSNs, addresses, and DOB increases the risk of identity theft.

- Financial Fraud: With access to personal data and dehashed passwords, there is a heightened risk of unauthorized financial activities.

- Privacy Violation: Selfies and scans can be misused, leading to privacy invasions and potential blackmail.

🛡️ Prevention Tips

For affected users and companies, here are some steps to mitigate the damage and enhance security:

For Users:

- Change Passwords: Immediately update passwords for your Lenme account and any other accounts using the same password.

- Monitor Accounts: Regularly check bank statements and credit reports for any suspicious activity.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your accounts.

- Alert Financial Institutions: Inform your bank and other financial services providers about the breach.

- Freeze Credit: Consider placing a credit freeze to prevent new accounts from being opened in your name.

For Companies:

- Encrypt Sensitive Data: Ensure all personal and financial data is encrypted both in transit and at rest.

- Regular Security Audits: Conduct periodic security assessments to identify and rectify vulnerabilities.

- Employee Training: Educate employees on data security best practices and phishing attack prevention.

- Access Controls: Implement strict access controls and regularly review permissions.

- Incident Response Plan: Develop and test a robust incident response plan to address potential data breaches swiftly.