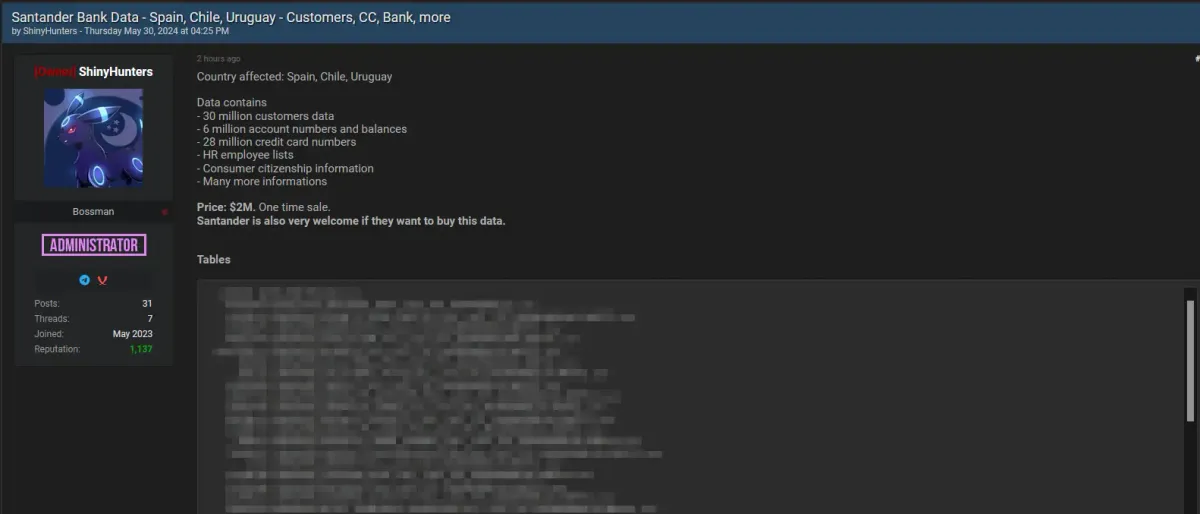

Sensitive Data of 30 Million Santander Customers Leaked in $2M Cyberattack

Santander Bank hit by major data breach. 30 million customers' data compromised by ShinyHunters. Find out how to protect yourself. #CyberSecurity #DataBreach #Santander

Company Overview

Santander Bank is a major global financial institution headquartered in Spain. It operates extensively across Europe, Latin America, North America, and other regions, providing a wide range of banking services, including retail banking, corporate banking, and asset management.

Breach Details

- Date of Discovery: May 30, 2024

- Affected Regions: Spain, Chile, Uruguay

- Data Compromised:

- 30 million customer records

- 6 million account numbers and balances

- 28 million credit card numbers

- HR employee lists

- Consumer citizenship information

- Additional sensitive data

Threat Actor Profile: ShinyHunters

ShinyHunters is a notorious cybercriminal group that emerged in 2020. They are known for orchestrating a series of high-profile data breaches across various industries, targeting both large corporations and smaller entities. Here are some key details about the group:

- Formation and Activities: ShinyHunters began their operations in 2020, quickly gaining notoriety for a spree of data breaches. They primarily employ phishing attacks to steal login credentials, which they then use to infiltrate corporate systems and exfiltrate valuable data (SC Media) (SOCRadar® Cyber Intelligence Inc.).

- Notable Breaches:

- Microsoft GitHub (2020): ShinyHunters claimed to have stolen over 500GB of data from Microsoft’s private GitHub repositories (Wikipedia).

- Tokopedia (2020): They offered for sale a database containing information on 91 million users of Indonesia's largest online store (SOCRadar® Cyber Intelligence Inc.).

- Wattpad (2020): Data of 271 million users was initially sold and then publicly released, including sensitive information such as passwords and emails (SOCRadar® Cyber Intelligence Inc.).

- AT&T (2022): They claimed to have breached AT&T’s systems, obtaining over 70 million records containing PII (SOCRadar® Cyber Intelligence Inc.).

- Operational Tactics: The group is known for creating sophisticated phishing webpages that mimic legitimate business login pages. They lure victims through phishing emails, collect credentials, and use them to access corporate networks and steal data (Wikipedia).

- Legal Actions: Key members of ShinyHunters have faced legal repercussions. Sebastien Raoult, a prominent member, was arrested in Morocco in 2022, extradited to the US, and sentenced to three years in prison for his involvement in various cybercrimes (SC Media) (ITPro).

Impact Analysis

- Financial Impact: The stolen data is being sold for $2 million, indicating its high value. Potential losses for affected individuals and Santander itself could be substantial.

- Reputational Damage: The breach significantly undermines customer trust in Santander's ability to protect sensitive information, potentially leading to a loss of customers and market share.

- Regulatory Consequences: Santander may face hefty fines and legal actions from regulatory bodies due to the breach of personal data, especially under stringent regulations like GDPR in Europe and similar laws in Chile and Uruguay.

- Customer Impact: Customers are at risk of identity theft, financial fraud, and other malicious activities as their personal and financial information is exposed.

Prevention Tips

- For Individuals:

- Monitor your bank accounts and credit reports regularly for any unusual activity.

- Use strong, unique passwords for all financial accounts and enable two-factor authentication (2FA).

- Be cautious of phishing emails or messages that may try to exploit the breach.

- For Organizations:

- Implement advanced cybersecurity measures, including intrusion detection systems (IDS) and regular security audits.

- Educate employees on cybersecurity best practices and conduct regular training.

- Encrypt sensitive data and ensure robust access controls.

- Develop a comprehensive incident response plan to quickly address any future breaches.