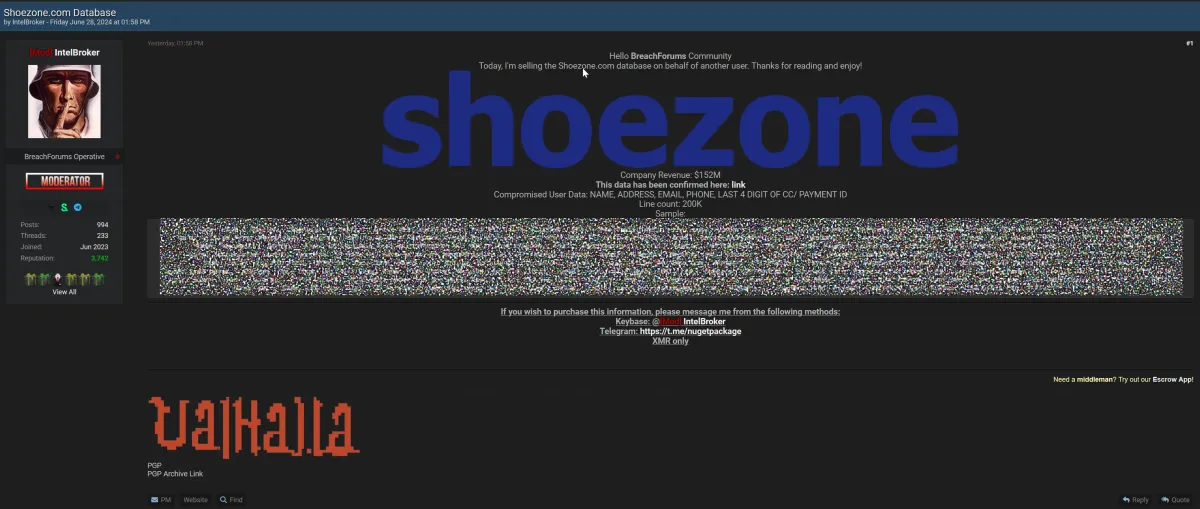

Shoe Zone Data Breach Exposes 200K Customer Records

Breaking: Shoe Zone has suffered a significant data breach affecting 200K customers. Personal and financial information has been compromised.

Shoe Zone is a prominent UK-based footwear retailer with an extensive network of stores and a robust online presence. Known for offering affordable footwear, Shoe Zone has a significant customer base, contributing to its reported annual revenue of $152 million.

Breach Details

- Date of Incident: June 28, 2024

- Threat Actor: IntelBroker, a known BreachForums operative

- Data Compromised:

- Names

- Addresses

- Email addresses

- Phone numbers

- Last 4 digits of credit cards

- Payment IDs

- Total Records: Approximately 200,000

Incident Summary

On June 28, 2024, a data breach involving Shoe Zone was announced by IntelBroker on BreachForums. The threat actor disclosed the database of Shoe Zone, highlighting the compromised data of around 200,000 individuals. The data included sensitive personal information and partial financial details, posing significant risks to affected customers.

Threat Actor Profile

IntelBroker is a well-known entity within cybercriminal circles, particularly active on BreachForums. With a history of selling and trading compromised data, IntelBroker's involvement in this breach signifies a serious security lapse. The modus operandi includes posting on underground forums, selling data through secure channels like Keybase and Telegram, and accepting payments in cryptocurrencies, specifically Monero (XMR).

Name: IntelBroker

Forum Role: Moderator on BreachForums

Reputation: IntelBroker is a well-known figure on BreachForums with a high reputation score of 3,742, indicating significant activity and trust within the community. On BreachForums alone he has 994 posts, and 233 threads.

Motivation: Likely financially motivated, as the data is being sold on the dark web.

Impact Analysis

The Shoe Zone data breach has multiple implications:

- For Customers:

- Risk of identity theft due to the exposure of personal information.

- Potential financial fraud leveraging the partial credit card details.

- Increased phishing attacks targeting their email addresses and phone numbers.

- For Shoe Zone:

- Reputational damage affecting customer trust and brand loyalty.

- Potential financial losses from customer lawsuits and regulatory fines.

- Operational disruptions due to necessary security overhauls and response measures.

What to do if affected

1. Monitor Your Financial Accounts Closely

- Check Statements: Regularly review your bank and credit card statements for unauthorized transactions. Look for any small charges that might be test charges by fraudsters.

- Set Up Alerts: Enable transaction alerts with your bank or credit card provider to receive real-time notifications of any account activity.

2. Secure Your Online Accounts

- Change Passwords: Immediately change passwords for your Shoe Zone account and any other accounts that might use the same password.

- Use Strong Passwords: Create strong, unique passwords for each account. Avoid using easily guessed information.

- Password Manager: Use a password manager to help generate and store strong passwords securely.

- Enable Multi-Factor Authentication (MFA): Add an extra layer of security to your accounts by enabling MFA wherever possible. This usually involves receiving a code on your phone or email that you must enter in addition to your password.

3. Protect Your Email and Phone Number

- Be Wary of Phishing: Be extra cautious with emails and text messages. Fraudsters may use your email and phone number to attempt phishing attacks.

- Verify Before Clicking: Do not click on links or open attachments from unknown senders. Verify the source first.

- Report Phishing Attempts: If you receive a suspicious email or message, report it to your email provider or phone carrier.

4. Address the Physical Address Exposure

- Monitor Mail: Keep an eye on your mail for any suspicious activity, such as unfamiliar packages or mail that you did not expect.

- Identity Theft Protection: Consider signing up for an identity theft protection service that can help monitor your personal information and alert you to potential fraud.

5. Take Action on Credit Card Information

- Check Your Credit Report: Review your credit report for any signs of fraudulent activity. You can get free reports from the major credit bureaus (Equifax, Experian, TransUnion) at AnnualCreditReport.com.

- Place a Fraud Alert: Contact one of the major credit bureaus to place a fraud alert on your credit file. This makes it harder for identity thieves to open accounts in your name.

- Consider a Credit Freeze: If you believe your financial information is at serious risk, consider placing a freeze on your credit. This prevents new creditors from accessing your credit report entirely.

6. Contact Financial Institutions

- Notify Your Bank and Credit Card Companies: Inform your bank and credit card companies about the breach. They can monitor your accounts for suspicious activity and may suggest replacing your credit cards.