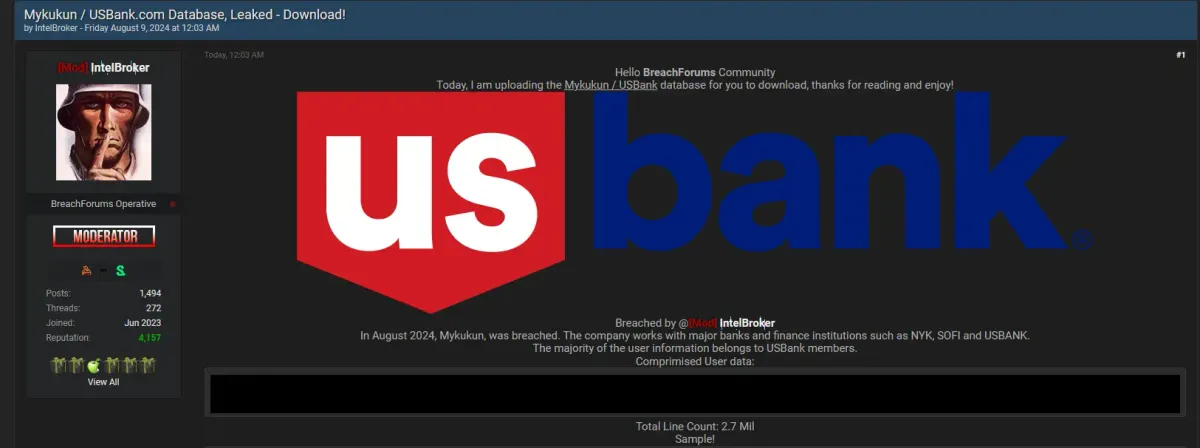

USBank Data Breach: 2.7 Million Users Exposed by IntelBroker

USBank and Mykukun's database has been leaked by the hacker IntelBroker, compromising 2.7 million users' data. #DataBreach #Cybersecurity

In August 2024, a significant data breach was reported involving the databases of Mykukun, a financial technology firm, and USBank, a major banking institution in the United States. The breach was orchestrated by a notorious threat actor known as IntelBroker, who leaked a database containing the personal and financial data of approximately 2.7 million users. The leaked information, primarily belonging to USBank customers, has raised alarms within the cybersecurity community due to the sensitive nature of the data involved.

Company Profiles

Mykukun

Mykukun is a relatively lesser-known fintech company that provides a range of financial services, including mortgage management, home improvement loans, and credit score monitoring. The company collaborates with major financial institutions, offering its technology solutions to streamline financial processes for both businesses and consumers. Mykukun’s partnerships with firms like USBank, NYK, and SOFI have positioned it as a key player in the backend operations of several large financial entities. However, this breach has cast a shadow over the company's security practices and its ability to protect sensitive financial data.

USBank

USBank, officially known as U.S. Bancorp, is one of the largest banks in the United States, with a broad portfolio of services including commercial banking, wealth management, and payment services. With assets totaling over $650 billion, USBank serves millions of customers across the country, making it a prime target for cybercriminals. The bank is known for its extensive digital banking services, which include online and mobile banking, thus amplifying the impact of any data breach affecting its infrastructure.

Details of the Breach

The breach was announced on BreachForums by IntelBroker, a well-known and influential figure in the underground hacking community. The forum post highlighted the release of a database containing over 2.7 million records, predominantly associated with USBank customers. The data, believed to have been obtained from Mykukun’s systems, includes highly sensitive information such as names, addresses, Social Security numbers, and banking details.

IntelBroker is known for targeting high-profile companies, especially those in the financial sector, making this breach particularly concerning. The breach was likely executed through a combination of vulnerabilities in Mykukun's security infrastructure, although the exact method of infiltration remains unclear.

Breach Details

- Date of Breach: August 2024

- Threat Actor: IntelBroker, a known figure on BreachForums, claimed responsibility for this breach.

- Leaked Data: The database allegedly contains information from 2.7 million users, primarily associated with USBank.

- Nature of Data: Compromised user data likely includes sensitive financial and personal information due to the nature of the institutions involved.

Impact Analysis

The implications of this breach are severe, given the nature of the data exposed:

- Financial Risk: The leaked data includes banking details that could be used for unauthorized transactions, fraud, and other financial crimes. Affected customers may face direct financial losses and a long process to resolve fraudulent activities.

- Identity Theft: With Social Security numbers and personal identifiers compromised, victims are at heightened risk of identity theft. This could lead to long-term issues such as damaged credit scores and legal complications.

- Corporate Reputation: Mykukun and USBank will likelyto adequately protect customer data face significant reputational damage. Customers may lose trust in these institutions, potentially leading to customer churn and increased regulatory scrutiny.

- Legal Ramifications: The breach could result in legal actions against Mykukun and USBank, particularly if they are found to have failed to adequately protect customer dataEnabling 2FA wherever possible enhances account security. Regulatory bodies may also impose fines or other penalties.

Recommendations for Affected Individuals

If you believe you may be impacted by this breach, it is crucial to take immediate steps to safeguard your personal and financial information:

- Monitor Financial Accounts: Regularly review your bank statements and credit reports for any unauthorized activity. Report suspicious transactions to your bank immediately.

- Change Passwords: Update passwords for online banking and other financial accounts. Use strong, unique passwords and consider using a password manager.

- Enable Two-Factor Authentication (2FA): Enabling 2FA wherever possible enhances account security, adding an extra layer of protection against unauthorized access.

- Place a Fraud Alert: Contact credit bureaus to place a fraud alert on your credit reports, which can help prevent identity thieves from opening accounts in your name.

Corporate Response and Future Prevention

For companies in the financial sector, this breach underscores the importance of robust cybersecurity measures:

- Invest in Security Infrastructure: Regularly update and patch software to protect against known vulnerabilities. Implement advanced threat detection systems to identify and mitigate potential breaches before they occur.

- Conduct Security Audits: Regular penetration testing and security audits can help identify weaknesses in your system. Addressing these vulnerabilities promptly can prevent breaches like this one.

- Employee Training: Ensure Aall employees are trained in cybersecurity best practices, including recognizing phishing attempts and other common attack vectors.

- Develop a Strong Incident Response Plan: A clear and effective incident response plan can significantly reduce the damage caused by a breach. Regularly review and update this plan to address new threats.